Secular (adjective) - in economics, occurring or persisting over an indefinitely long period.

With stock markets around the world continuing to rally, it seems that the all clear has been sounded. Indeed yesterday in response to JP Morgan announcing a dividend hike, the Federal Reserve announced the results of the another round of bank stress tests. Out of 19 banks, only four failed what seems to be a pretty dire scenario:

To fail meant that the bank had less than a 5% capital ratio, which means the bank is not well insulated to losses. Stocks rallied to new highs. In response to another positive Fed report on the economy, bonds have fallen rapidly as investors see far better that 2% yields in the stock market.

Life is good again. Or is it? It's during this time that I feel it's necessary to look at the big picture.

- 13% unemployment

- 50% drop in stock prices

- 21% further decline in housing prices

To fail meant that the bank had less than a 5% capital ratio, which means the bank is not well insulated to losses. Stocks rallied to new highs. In response to another positive Fed report on the economy, bonds have fallen rapidly as investors see far better that 2% yields in the stock market.

Life is good again. Or is it? It's during this time that I feel it's necessary to look at the big picture.

- Greece's 2nd bailout for €130 billion was approved after the successful debt-swap where approximately €200 billion of bonds were swapped with new bonds worth €100 billion. So net-net, the Greeks are €30 billion more in the hole.

- Spain agreed with the EU to meet a 5.3% deficit target instead of a unilaterally announced 5.8% target. Originally Spain's deficit target for 2012 was 4.4%. Spain's deficit was 8.5% in 2011. In response, Spain's 10 year bond yield is rising again though at 5.17% it's not in danger territory yet.

- Portugal's ten year bond yield is 13.72%, so don't fall into the trap thinking that Greece will be the only EU country to default.

- Debts in other European countries remain. Additionally these countries will need to fund their contributions to the European Stability Mechanism (ESM). See To the Moon and Back.

- China announced it would target GDP of 7.5% instead of 8%. For Australia, Brazil, or Canada, which export commodities to China, this is cause for concern. Additionally, China has been remarkable in achieving steady high returns over the years. The last time I saw such consistency with returns, people didn't think anything was strange about it either, until the floor fell out from under Bernie Madoff.

Furthermore nothing has changed in the US regarding debt levels or a political solution to future entitlement liabilities.

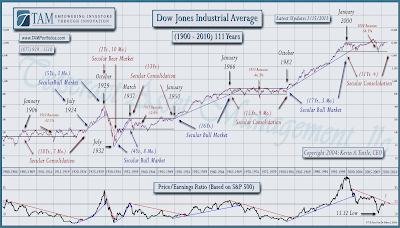

While I believe that the economy has improved, how much has really changed? In my mind, nothing has really changed. Thus I have trouble seeing the current stock rally as anything other than a cyclical bull market within a secular consolidation. What is a cyclical bull market? If you answered (or guessed) a bull market that lasts a few years, you are correct. The last cyclical bull market started 2002/2003 and ran until 2007.

In addition to cyclical bull markets, cyclical bear markets also exist. Cyclical simply denotes a market trend that is shorter than a secular trend. As shown on the picture below courtesy of my friends from Tesseract Asset Management (please note that the orange and green comments are mine), cyclical trends last a few years. You can easily distinguish 2 cyclical bear markets and 2 cyclical bull markets since 2000.

|

| Source: Tesseract Asset Management |

Falling back on the 100 Year Market Theory from Kevin Tuttle, stocks are overvalued if the 10 year moving average Price/Earnings ratio is greater than 22 (see also Market Risk, Are You Managing It?). The current cyclical bull market has pushed up the market's P/E. http://www.multpl.com/ lists the today's P/E at 23.25.

Illustrated on the full 100 Year Market Theory chart below, we find that P/E ratios can certainly go much higher than 22. However, secular bull markets do not start until P/E has reached 10 or less. We're not there still.

The chart also illustrates another interesting occurrence, secular bull markets and secular consolidations take a similar amount of time to run their course. Should this remain true, it means we still have a few more years until the next secular bull market starts.

|

| Source: Tesseract Asset Management |

What Does this Mean for Me

If you're have a Dollar Cost Average portfolio, hopefully you learned something new. It is a rare that I change anything in my wife's 401k throughout the course of a year.

For my Retiree portfolio, I'm staying the course as I think there is still at least as good of chance for the market to fall as to rise.

Parting Thoughts

One interesting fact I found on http://www.multpl.com/ was the P/E for the Black Monday crash in October 1987 was ~17.5, which means that bad things can occur when investors assume a lower level of risk. I'm not saying that a one day market crash like that will happen, or even can happen considering the rules put into place since that day. I'm just saying that I found it interesting...

With that said, don’t let your investments keep you up at night. If they do keep you awake, you may be taking more risks than you are comfortable with. Talk to a professional about reallocating to less risky investments so that you can sleep. During your conversation with said professional, ask why they believe that their recommendation is less risky. If you are not convinced by their explanation, don’t invest. Remember:

- It’s your nest egg.

- Opportunities are easier to make up than losses.