History doesn't repeat, but it often rhymes.

- Mark Twain

Before we get into today's edition of 14 Minute Investor, I wanted to share why I've been missing in action these past few days. In case you haven't read

Maybe I'm Not a Lazy Investor, my full time occupation is stay-at-home dad. Occupied is exactly what my 5 year old and 2 year old keep me. Rather than delve in the details, please understand that I usually find myself writing after bedtime - more often than not, my own bedtime. So while I strive to write one article for each day of the workweek, please forgive me if I miss a day. I'd rather skip a day than try to rush an article out that isn't up to my standards.

Now on to the article...

Have you ever wondered what the difference is between good investors and great investors? While I cannot say that I have a complete answer to this question, I know one difference is how each investor manages risk.

What Influences Your Investment Decisions

Very early in my investing lifetime, I looked at the past returns of my 401k mutual funds and said, "I want those returns." As I started in the late 1990s, the returns were large by historical standards. Indeed I got to enjoy about 2 years of nice returns. However, the good times came to an end. From

Maybe I'm Not a Lazy Investor:

In March 2000, people decided that companies should earn a profit and not simply count how many eyeballs look at them daily. Over the next several months, the stock market crashed and so did my 401k.

During this time, I did what I was supposed to do. I kept on buying, which dollar-cost averaged my nest egg into cheaper shares. Still, that didn't take the pain away. I decided that I needed to learn how to look for warning signs of future market crashes, as well as learn from my mistakes - such as not having diversified into a bond fund those initial years, which would have significantly cushioned the blow.

...

Since the Nasdaq Crash of 2000, I had become a voracious reader of economic and financial subjects.

|

| Source: Yahoo |

Did you notice anything in particular about my opening sentence? Here it is again: Very early in my investing lifetime, I looked at the past returns of my 401k mutual funds and said, "I want those returns." One word stands out to me - returns. I was managing for returns, and my portfolio suffered.

What I should have been doing was managing risk. Managing risk is critical because if you do a poor job managing risk, then losses hinder the potential growth of a portfolio. For example if you lose 50% of your portfolio, then you need a 100% gain simply to get back to even.

By prudently managing risk, investment returns will follow as losses should prove minimal. And while there are several types of investment risk that need to be managed, this article introduces one type - market risk.

Measuring Market Risk in 1999

Remembering those days 12 years ago is somewhat of a blur. One thought I clearly remember is "from now on, I want to know what the 'smart money' is doing. Certainly the smart money knows about managing risk." I cannot recall how many websites and periodicals I reviewed attempting to find the "smart money" as it was a lot. Being frugal, I decided to try a magazine subscription or two and then focused on finding the best material that was free over the Internet. One of the websites that I discovered was

Minyanville.

Minyanville is the brainchild of CEO Todd Harrison who created it to give something back to the community after many successful years in the financial industry. Minyanville's mission is to affect positive change through financial understanding, from the ABCs to the 401(k)s. With a roster of more than 40 world-class "Professors" comprised of traders, money managers and some of the best minds in business, readers can find well over a dozen free daily articles as well as subscription products.

I spent a LOT of time and learned a lot of things on Minyanville. Today, I'm going to share one of the most memorable things I saw there about 8 years ago. As you might guess, it's centered on market risk.

Much like the concept of

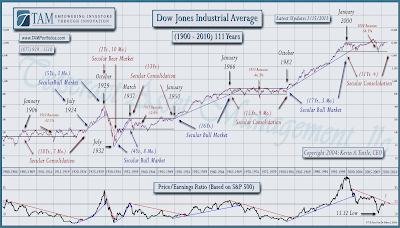

lazy investing, the chart above from Kevin Tuttle of

Tesseract Asset Management (formerly Tuttle Asset Management) was an eye-opener to me, and let me tell you why.

In front of you is 103 years of the Dow Jones Industrial Average (DJIA) living history. Broken into two sections, this chart displays the price history of the DJIA over time on top, and the 10 year moving average Price/Earnings (P/E) ratio of the S&P 500 on the bottom.

Now for the uninitiated, P/E is a standard measure of risk. It tells you how many dollars you are paying for $1 of earnings performance. From the articles I was reading back then, $15 was considered fairly valued.

Taking a look at the chart's P/E section, you'll note the two horizontal lines representing P/E ratios of 10 and 22. At 10, stocks are considered undervalued and on sale. At 22, stocks are considered overvalued and at risk of falling in price.

Take a look at the year 1999. I wish I had seen this chart back then as the P/E portion of the chart was lengthened vertically just to fit the curve. Stocks were not only overvalued, but in orbit with the International Space Station.

Taking a Closer Look at Cyclical Market Risk

I am grateful to have permission to use the 2010 chart, so let's take a closer look at all of the information we can gain from it (please click the image to enlarge it).

To this day, I have never seen a chart like this. This chart is significant because it matches up market risk versus price performance in an easy-to-read graphic - not a table that listed over a range of years both the high/low price for a year, the high/low P/E for that year. Thus we can visualize the long-term, or secular, trends easily.

Focusing on the P/E portion again, we see that market risk is constantly changing. Over many years though, these changes trend from low-to-high P/E (represented by rising blue line) to high-to-low P/E (represented by falling red line). Note that the blue lines always start at or below an undervalued P/E of 10. Likewise, the red lines always start at or above an overvalued P/E of 22.

Now let's look at the DJIA price history. The first thing I notice are rising blue lines designating rising stock prices. These rising stock prices directly correlate to the blue lines below designating a rising P/E and take place periods many years.

Next, the black "channels" designate years where the market remains within a price range, or as the chart says - experiences a secular consolidation. These black channels, as well as the market crash from the Great Depression, directly correlate to the red lines designating a falling P/E.

Putting it all together, we see that over long periods of time, the stock market cycles from undervalued to overvalued and back. Note that secular bull markets can go up far longer than many would think prudent. Additionally caution should be exhibited in overbought markets as they tend to work themselves out as either:

- a function of price, meaning a large, "quick" drop in price like in the Great Depression - bringing the overall P/E ratio down to undervalued levels, or

- a function of time, meaning a long multi-year, secular consolidation where corporate earnings catch up to price - bringing the overall P/E ratio down to undervalued levels.

Benefits of the 100 Year Market Theory Chart

As the quote of today's article says, history doesn't repeat, but it often rhymes. Since 2000, the stock market has been consolidating as a function of time. Reading the 100 Year Market Theory Chart, we see that the 2008 crash has yet to tag the traditional undervalued P/E of 10. Thus, it can be surmised that the current secular consolidation that started in 2000 should continue.

Yet A Word of Caution

Even though the 100 Year Market Theory illustrates that stock market risk cycles from undervalued to overvalued, policy intervention from governments and central banks may prevent markets from hitting a P/E of 10.

The G4 central banks (http://www.cumber.com/content/misc/G4_Charts.pdf) have taken the size of their collective balance sheet from $3.5 trillion to $9 trillion. That number is likely to rise. The G4 have extended duration so that the focus of their policy is not just in the overnight lending rate or in the very short term. Massive liquidity has blunted liquidity squeezes everywhere in the world.

... by unleashing a flood of liquidity in the form of low interest rates, quantitative easing, and refinancing operations, world central banks distort financial markets encouraging investors to take on more risk. Stocks are a natural fit, especially with reports and prognostications of an improving economy. Furthermore, the Federal Reserve has strongly hinted at more quantitative easing in December and January.

Now put yourself in the shoes of a financial manager. Your worst fear is the thought of underperforming your peers. To a financial manager, underperformance is worse than losing money. Thus it is to be avoided at all costs.

Liquidity finds a home in stocks and commodities, pushing up prices. Can policy intervention start a new secular bull market when P/E hasn't hit the traditionally undervalued mark? That remains to be see.

Another risk that I know I've beaten to death is the debt. Can liquidity beat debt? Again that remains to be seen, but debt has to be paid, restructured, or defaulted upon. Whether we like it or not, we certainly do live in interesting times.

Parting Thoughts

The 100 Year Market Theory Chart bestows different benefits to different people. For those who dollar cost average in their retirement plans, the chart provides a powerful incentive to continue the course during the current secular consolidation. Your risk is managed by constant buying regardless of direction. When the next secular bull market starts, you will be very happy. Dollar cost averaging enabled me to regain from my losses much quicker than had I given up in 2000.

For people like me with retiree plans, the chart provides guidance on when taking more risk with our precious funds is prudent. No one wants to out live their retirement funds.

While there's much more that can be discussed about 100 Year Market Theory Chart, it's time to wrap up this article. Be assured that I will revisit the chart in future articles as today was really an introduction. As a side note, I look forward to the 2011 chart. As the market basically had a flat year and corporate earnings improved, I predict that the P/E line should have ended 2011 lower. How much lower - I can't wait to see.

Finally in the spirit of finding the best material that's free over the Internet, I did see that Tesseract Asset Management offers

Free Research. While I have yet to receive my first email, I will say that I read Kevin's work whenever I see it on Minyanville. So I look forward to my first installment.

Disclaimer: Please remember that I’m just a guy sharing information on a blog, and this is NOT official investment advice. Any action that you take as a result of information, analysis, or advertisement on this site is ultimately your responsibility. Please consult your investment adviser before making any investment decisions. During your conversation with said investment adviser, ask why they believe in their recommendation. If you are not convinced by their explanation, any action that you take or forego is also your responsibility. Just in case you missed that, you are responsible for your investments.

With that said, don’t let your investments keep you up at night. If they do keep you awake, you may be taking more risks than you are comfortable with. Talk to a professional about reallocating to less risky investments so that you can sleep. During your conversation with said professional, ask why they believe that their recommendation is less risky. If you are not convinced by their explanation, don’t invest. Remember:

- It’s your nest egg.

- Opportunities are easier to make up than losses.

Despite the progress made, there is still a long way to go in a context that is more favourable but still characterised by elements of uncertainty.